A Stable Alternative in an Unstable World

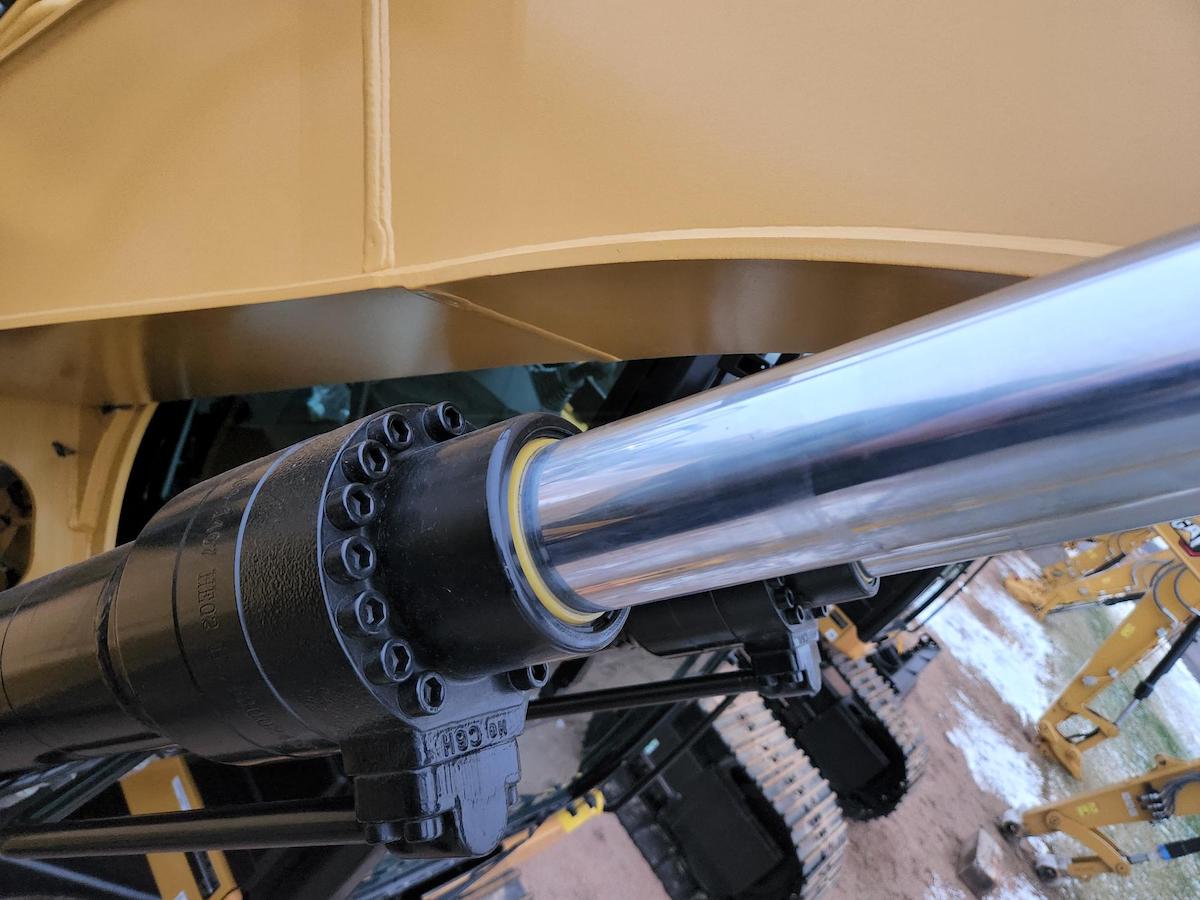

With hydraulic cylinder shipments from China and India being delayed by 2 to 4 weeks because of geopolitical problems affecting the Red Sea and Suez Canal, and low water levels in the Panama Canal prolonging shipping times, our country’s ability to manufacture and maintain essential industrial equipment that uses cylinders is in potential jeopardy. Likewise, the stability of necessary services such as air travel, refuse collection, and warehousing could be compromised if there is a shortage of new and replacement cylinders for aircraft, trucks, forklifts, and other kinds of vehicles and equipment.

With hydraulic cylinder shipments from China and India being delayed by 2 to 4 weeks because of geopolitical problems affecting the Red Sea and Suez Canal, and low water levels in the Panama Canal prolonging shipping times, our country’s ability to manufacture and maintain essential industrial equipment that uses cylinders is in potential jeopardy. Likewise, the stability of necessary services such as air travel, refuse collection, and warehousing could be compromised if there is a shortage of new and replacement cylinders for aircraft, trucks, forklifts, and other kinds of vehicles and equipment.

Caught in the Middle (East)

This recent article by Rico Luman, an economist with ING Group (a Dutch multinational banking and financial services corporation headquartered in Amsterdam), clearly explains the crisis that Red Sea and Suez Canal shipping faces.

This recent article by Rico Luman, an economist with ING Group (a Dutch multinational banking and financial services corporation headquartered in Amsterdam), clearly explains the crisis that Red Sea and Suez Canal shipping faces.

With just under one-third of the world’s traded consumer goods traveling the Suez route to markets in Europe and the Americas, a doubling or tripling of shipping rates due to rerouting ships around the Cape of Good Hope (at the southern tip of Africa) to avoid Houthi militant attacks led by an Iran-back group that originated in Yemen in the 1990s could double or triple container rates, potentially adding 5%-10% to the cost of shipments.

Those figures are significant enough to be the difference between profitable and non-profitable operations for many businesses or accurate and inaccurate budgets for public agencies such as municipal departments of sanitation and public works. To put it bluntly, the numbers are alarming and should be cause for concern to anyone who owns or operates a manufacturing business, or who is responsible for purchasing industrial products used in critical equipment.

Panama Canal Situation Cut and Dried (Out)

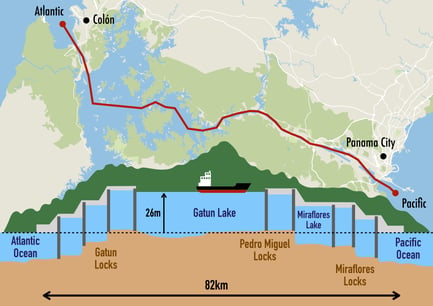

A climate-related shipping crisis in our own hemisphere is occurring in the Panama Canal Zone, described clearly by this Fortune magazine article. Due to a lack of rain, water levels are 6 feet below their usual levels, which is reducing daily traffic through the Canal by roughly 40%, from 38 ships to 24.

A climate-related shipping crisis in our own hemisphere is occurring in the Panama Canal Zone, described clearly by this Fortune magazine article. Due to a lack of rain, water levels are 6 feet below their usual levels, which is reducing daily traffic through the Canal by roughly 40%, from 38 ships to 24.

As the article points out, while the Panama Canal normally handles about 3% of global maritime trade volumes, it is responsible for a whopping 46% of containers moving from Northeast Asia to the U.S. East Coast. Those numbers are likely to drop significantly as the water available to operate the canal continues to become scarce.

What’s more, the predictions for rainfall during this typically rainy season call for less precipitation than usual, so traffic could become even more curtailed than it is already. As a result of this situation, ships must use slower alternate routes around the famously rough Straits of Magellan (tip of South America), adding cost and delays to shipments.

As for solutions, all of them are long-term and are projected to take a decade or more to implement. The consensus among experts is that the most practical remedy is to build a dam on the Indio River and drill a tunnel through a nearby mountain to pipe fresh water 5 miles into Lake Gatún to feed the locks of the canal.

As Mike DeAngelis, the Copenhagen-based Head of International Solutions at FourKites, Inc., a supply chain platform solutions provider with offices in North America, Europe, and India puts it in this recent Port Technology International article, “Supply chain turbulence is likely to persist, requiring vigilance and proactive planning to withstand additional shocks.”

Although he was referring to circumstances in the Red Sea and Suez Canal region, the same wisdom applies to the situation in the Panama Canal Zone.

Mr. DeAngelis’s observation that vigilance and planning are essential to weathering a storm that is likely to persist throughout this calendar year is highly insightful and should spur into action anyone who depends upon overseas suppliers for critical parts or components.

Creating New Supply Chains

To protect yourself from the uncertainties of global crises such as political instability in the Middle East and climate-related challenges in the Panama Canal Zone, it is highly advisable to reconfigure supply chains in ways you may have done during the COVID-19 pandemic several years ago.

Those actions include: 1) Mapping your overseas supply chain; 2) Re-establishing or strengthening relationships with existing domestic suppliers; 3) Identifying new potential domestic suppliers; and 4) Develop a long-term supply strategy based on your findings.

When it comes to mapping your supply chain, if it crisscrosses the globe, now is the ideal time to take stock of how much you are actually saving and how much more expensive doing business with overseas suppliers could be if the crises in the two shipping lanes we have been discussing do not ease up anytime soon.

When it comes to mapping your supply chain, if it crisscrosses the globe, now is the ideal time to take stock of how much you are actually saving and how much more expensive doing business with overseas suppliers could be if the crises in the two shipping lanes we have been discussing do not ease up anytime soon.

Regarding re-establishing relationships with former suppliers, conversations can be awkward at first but as that famous line from the movie “The Godfather” goes, “This is business, not personal, Sonny.” In that vein, former suppliers must be ready for the influx of returning customers weary of supply chain and other problems with inconsistent international suppliers.

As for identifying potential new suppliers, you may have some in-mind based on what you have read in trade journals or whom you have met at tradeshows or conferences over the past couple of years. You can also ask colleagues for their input to make certain you are casting a proverbial net widely yet in a targeted way. This process can also strengthen team unity at a time when it is arguably more critical than ever to the success of your organization.

The key to reshoring your supply chain is to do it quickly rather than slowly because, chances are, competitors are thinking about doing the same thing. As the saying goes, “the early bird gets the worm.”

If you are like other manufacturers, your “supply chain adjustment muscles” should still be toned from the pandemic, which should give you more confidence now than you may have had before the global disruptions. As you may recall, shutdowns were occurring at a breakneck pace in the late first quarter and early second quarter of 2020 and supply chains remain disrupted throughout that year and deep into 2021 (and beyond).

The reshoring that occurred during that year of misfortune means there are more options now than there were several years ago, which can work in your favor.

Whether you need a domestic source for hydraulic cylinders or an impartial third party that can provide you with experienced-based insights to reconfiguring supply chains, the Ligon Hydraulics team is ready to help. Over the years, customers, suppliers, and strategic partners have gone the extra mile to help us, and we are happy to pay it forward. To benefit from our expertise…